In 2025, Andorra continues to consolidate itself as one of Europe’s most attractive destinations for those seeking moderate taxation, legal stability, and a high quality of life. This guide explains what tax residency in Andorra means, its requirements and types, and how to obtain it legally to benefit from a safe environment and a tax system with a maximum rate of just 10%.

Table of Contents

- Living and paying taxes in Andorra in 2025

- Why more and more people are choosing Andorra

- What it means to have tax residency in Andorra

- Types of residency in Andorra

- Andorra’s tax system in 2025

- International comparison

- Practical cases: Who benefits the most?

- Additional advantages of living in Andorra

- Key considerations before relocating

- How Summit Advisors can help you

1. Living and Paying Taxes in Andorra in 2025

Located between Spain and France, the Principality of Andorra combines the best of both worlds: mountain landscapes and European standards with its own transparent and competitive tax system.

The country, with just 468 km² and a population slightly above 88.000, offers one of the lowest tax burdens in Europe and a stable political environment.

In recent years, Andorra has transformed into a hub for financial, technological, and business services. Combined with modern infrastructure, full digital connectivity, and an exceptional natural environment, it has become an ideal destination for digital nomads, entrepreneurs, and passive-income residents seeking a balance between work and well-being.

2. Why More and More People Are Choosing Andorra

The profile of the new resident has evolved: it’s no longer limited to high-net-worth individuals. Today, freelancers, athletes, digital creators, investors, and business owners are also arriving.

Main reasons:

- Reduced and stable taxation: maximum rates of 10%.

- Institutional stability and very low crime rates.

- Open and international economy: agreements with the OECD and neighboring countries.

- Geographic proximity: 2 hours from Barcelona and Toulouse.

- High quality of life, nature, and efficient public services.

3. What It Means to Have Tax Residency in Andorra

Administrative residency is the immigration permit granted by the Andorran Government; Tax residency is the status that determines where your worldwide income is taxed.

A person is considered a tax resident if they:

- Remain in Andorra for more than 183 days in a calendar year; or

- Have in Andorra their main economic and personal interests.

Additionally, unless proven otherwise, the taxpayer is presumed to be a tax resident in the country where their spouse (not legally separated) and minor children reside.

Meeting these criteria ensures that your income is taxed exclusively in Andorra under its legislation, avoiding international double taxation.

4. Types of Residency in Andorra

4.1 Active Residency

Designed for those who work or run a business in Andorra. It may be requested by an employee with a local employment contract or by a self-employed professional who establishes a company.

a) Active residency for self-employment

Ideal for entrepreneurs or professionals operating through an Andorran company. The applicant must own at least 34% of the company and act as its administrator. This permit allows the holder to work for their own company and is one of the most in-demand options.

b) Active residency for employment

For employees with a job offer in Andorra. The permit is processed through the hiring company. There are quotas by sector and skill level, and the employee must prove their qualifications and relevant experience.

4.2 Passive or Non-Lucrative Residency

Designed for individuals who do not carry out local employment but have sufficient resources or passive income. This is the preferred option for rentiers, retirees, and investors. It requires an investment in Andorran assets and staying at least 90 days per year in the country.

Sub-categories include:

- Residency for cultural, scientific, or sporting interest: for individuals of international recognition.

- Residency for professionals with international projection: quota-limited, allows 90 days of presence in Andorra and travel throughout the year.

4.3 Digital Nomad Residency Permit

Since 2024, Andorra offers a specific permit for professionals who work online without a fixed location. This authorization allows residents to live in Andorra while providing services to foreign clients, provided they meet:

- Sufficient financial means

- Valid healthcare insurance

- Minimum physical presence of 90 days/year

- Approval by the Ministry of Economy

The initial permit is granted for two years and can be renewed up to a maximum of ten. It is particularly attractive for digital entrepreneurs and freelancers who value Andorra’s safety and connectivity.

5.Andorra’s Tax System in 2025

Andorra’s tax model is simple, competitive, and fully aligned with OECD standards. The country offers a tax framework that promotes investment and residency without compromising transparency or legal certainty.

5.1 Personal Income Tax (IRPF)

The Andorran personal income tax is among the lowest in Europe:

- First 24.000.-eur → exempt

- 24,001.-eur to 40,000.-eur → 5%

- Above 40.000.-eur → maximum 10%

This results in an effective tax burden of roughly 5% to 7% for most residents. Additionally, many financial and capital income categories—such as dividends or interest—are exempt, and there are deductions for housing and family dependents.

5.2 Corporate Income Tax (IS)

Corporate tax is levied at a general rate of 10% on company profits. The system is predictable and supports long-term tax planning.

5.3 General Indirect Tax (IGI)

Equivalent to VAT, IGI has a general rate of 4.5%, one of the lowest in Europe. There is a reduced rate of 1% for essential goods, and education, healthcare, and residential rent are exempt.

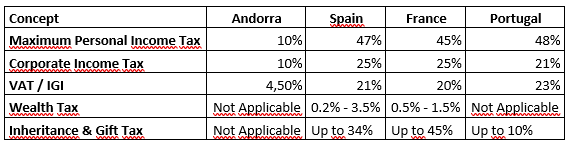

6.International Comparison: Andorra vs. Neighboring Countries

Compared to nearby countries such as Spain, France, or Italy, Andorra’s tax burden is significantly lower.

On average, global tax pressure in Andorra is 60% to 70% lower, resulting in substantial and sustained long-term savings.

7. Practical Cases: Who Benefits the Most from Tax Residency?

Self-employed professionals and digital nomads

Independent workers with international income benefit enormously. While their home countries may tax them between 30% and 45%, in Andorra their effective rate rarely exceeds 8%. The country offers modern digital infrastructure, full fiber-optic coverage, and a safe environment for global operations.

Investors and rentiers

People earning dividends, interest, or financial investment income enjoy significant exemptions. With no wealth tax or tax on unrealized capital gains, net returns can be 25% to 30% higher than in neighboring countries.

Entrepreneurs and business owners

Business owners who relocate or create a company in Andorra pay a flat 10% corporate tax, and dividends distributed to resident shareholders are exempt. The combined burden can be reduced by up to 70% compared to other European countries, without sacrificing legal stability or international reputation.

8. Additional Advantages of Living in Andorra

Safety and stability

Andorra is one of the safest countries in the world, with extremely low crime rates and a neutral foreign policy.

High-quality healthcare

The CASS (Andorran Social Security Fund) covers medical consultations, hospitalization, and treatments. It operates with a co-payment system: CASS covers 75%–90%, and the resident covers the rest. Private insurance can complement CASS coverage.

Trilingual education and multicultural environment

The public education system combines Catalan, Spanish, and French, and private schools offer English-language programs. This facilitates integration for international families.

Quality of life and nature

Clean air, mountain landscapes, and a peaceful lifestyle. Outdoor activities—skiing, hiking, cycling—are part of daily life.

Competitive cost of living

Living costs are about 20% lower than in major European capitals. Housing, food, and transportation are more affordable, though imported goods may be slightly more expensive.

9. Key Considerations Before Relocating

Before changing your tax residency, it is important to complete all formal steps correctly and avoid common mistakes:

- Ensure more than 183 days of real presence in Andorra

- Avoid maintaining an active habitual residence in the country of origin

- Transfer your economic center of interests (company, investments, invoicing)

- Notify the tax authority of your previous country of the change of residency

Proper planning—supported by local advisors—avoids double residency conflicts or penalties in the country of origin.

10. Want to Transfer Your Tax Residency to Andorra?

At Summit Advisors, we support professionals, entrepreneurs, and private individuals throughout the entire process:

- Personalized tax analysis

- Immigration procedures

- Company formation

- International tax planning

- Ongoing management and comprehensive advisory

Request a consultation and we will guide you through every step to relocate to Andorra efficiently and without complications.

This results in an effective tax burden of roughly 5% to 7% for most residents. Additionally, many financial and capital income categories such as dividends or interest are tax exempt, and there are deductions for housing and family dependents.